Ubiquity Credits (uCR)

In a debt cycle, the uAD protocol shall issue 'perpetual, depreciating premium' coupons.

- These coupons shall be issued at a premium that depreciates over time in the course of the debt cycle. For example, the coupons may be issued at a 30% premium at the very beginning of the debt cycle, and this premium shall depreciate over the course of the debt cycle.

- These coupons are 'perpetual' since they never expire like uCR NFT coupons. However, the coupons to uAD redemption ratio shall worsen over time, unlike uCR NFTs, which can be redeemed for uAD at a guaranteed ratio of 1:1, as long as they are unexpired.

The purpose of these coupons is to incentivize the purchase of debt right from the beginning of the debt cycle when the premium for uCR NFT isn't high enough for uAD holders to make a substantial profit.

This may especially be handy when the price of uAD attains substantial stability around the $1 peg, and the possible arbitrage return on buying uCR NFTs at a low premium decreases.

This is an extension of the base debt redemption mechanics.

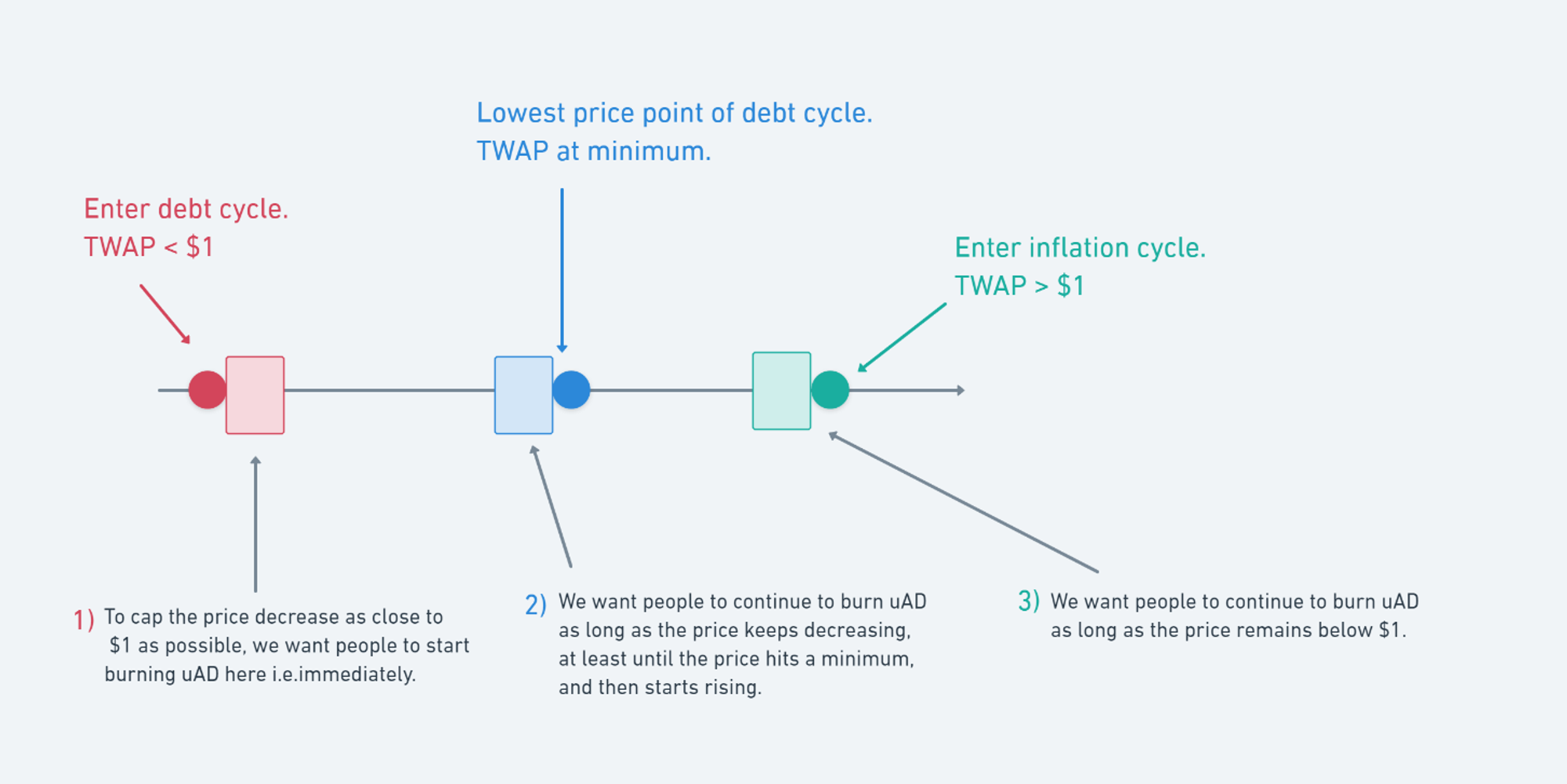

To ensure enough supply contraction of uAD in a debt cycle, we want what the labels and explanations in the diagram describe (1, 2, and 3). We want to place an incentive for participants

- To burn uAD as early in the debt cycle as possible.

- To continue to burn uAD even as the uAD price continues to decrease up to its minima.

- To continue to burn uAD up until TWAP = 1

The debt mechanism being proposed aims to provide sufficient incentive for 1,2, and 3, all with the aim of preventing prolonged debt cycles.

Two debt tokens : uCR NFT (i.e., debt coupons) and uCR (i.e., ‘auto redeem’ tokens)

In a debt cycle, a participant (i.e., uAD holder) can burn uAD in two ways. He can burn uAD in exchange for uCR NFT or he can burn uAD in exchange for uCR.

uAR

In a debt cycle, a participant can burn uAD tokens in exchange for uCR i.e. ‘auto redeem’ tokens. uAR can be exchanged 1:1 for uAD tokens in an upcoming inflation cycle (price of uAD above 1.00)

Minting of uCR

uCR tokens are minted to the participant burning x amount of uAD according to the formula:

Here, p is a constant greater than or equal to 1,

Blockheight_debt is the block height at the beginning of the debt cycle, and Blockheight_burn is the block height at the time of the participant burning uAD.- On average, a block is mined on the Ethereum blockchain every 13 seconds. Currently, there have been ~11 million blocks mined. So,

BH_debt / BH_burnremains very close to 1. The ratio becomes more stable over time.

- The constant p is a variable controlled by the DAO. The greater the value of p, the harsher the decrease of the rate at which uAR tokens are issued for a given amount of uAD tokens burned.

In this way, uCR tokens are issued at a decreasing rate over the course of the debt cycle. For a given x amount of uAD tokens, the earlier in the debt cycle you burn your tokens, the closer to a 1:1 ratio that you receive for burning debt coupons.

The contract balance: uCR pool + uCR NFT pool

The contract keeps track of a uCR pool, and a uCR NFT pool. The sum of uAD in each pool comprises the debt contract’s entire balance.

Redemption Formula

The debt contract has a single mint function that mints uAD to itself, i.e., the debt contract. uAD is minted according to the formula

Where:

- U(t) is the total uAD supply in circulation

- U(m) is the uAD supply minted during the current expansion cycle

The newly minted uAD first goes to the uCR pool. When the mint function is called, if the balance of the uCR pool is less than the total supply of uCR tokens, the amount of uAD required to bring the pool up to par with the uCRsupply is allotted to the uCR pool.

Once the balance of the uCR pool is equal to the total supply of uCR tokens -- the remaining newly minted uCR goes to the uCR NFT pool. The amount of uAD required to bring the uDEBT pool up to par with the uDEBT supply (unexpired uDEBTs at that moment) is allotted to the uCR pool.

After minting according to the above formula, if the uAD balance of the contract exceeds the sum of the total supply of uCR and uCR NFT, then excess uAD is distributed to the Treasury, bonded uAD holders, etc.

What purpose do uAR tokens serve?

The primary usefulness of uAR tokens is that they fulfill goal number (1). Since uAR tokens are issued at a decreasing rate, it is more profitable to burn uAD tokens for uAR tokens early in the debt cycle than later in the debt cycle.

Why uAR instead of uDEBT?

Acquiring uCR NFTs and then redeeming them in a first-come-first-serve manner is a highly competitive and difficult task (primarily due to bots) with a stressful end-user experience. At the cost of not enjoying a debt premium, a participant can avoid this competitive redemption mechanism by choosing to burn uAD for uCR instead of uCR NFT.

We anticipate most users will use the Ubiquity Auto Redeem contract for convenience.

A participant can instead redeem their uCR tokens without having to compete with anyone, as long as the balance of the debt contract has enough uAD to transfer to the participant in exchange for burning uCR tokens. There is an absence of competition when redeeming uCR for uAD because the mint function of the contract prioritizes the uAR pool. Before uCR NFT can even be redeemed, the contract makes sure the uCR pool is at par with the total supply of uCR tokens.

Why exchange uAD for uAR if (x amount of uAD) yields at most (x amount of uAR) tokens? Why not wait to acquire uDEBT with a premium?

A user can choose to do this if they wish. However, they must consider that the mint function prioritizes the uCR pool over the uCR NFT pool and that redeeming uCR NFT is a highly competitive bot-dominated activity. In all, they must evaluate the expiry risk of their uCR NFT.

Why does the mint function prioritize uAR pool over uDEBT pool?

The highest priority is the fulfillment of goal (1) on the first page. The ability to exchange uCR for uAD in an inflation cycle must almost be a guarantee.

uCR NFT have an expiration time, whereas uCR does not. So, this fact of the mint function prioritizing the uAD pool over the uCR NFT pool is another component to consider when evaluating a batch of uCR NFT expiry for secondary uCR NFT markets.

uCR NFT

uCR NFT tokens are debt coupons that are redeemable for uAD when the price of uAD is above 1.00. Read more here.

What purpose does the uDEBT token serve?

Unlike uCR, uCR NFT is issued at a premium, determined by the formula:

Here, R is the debt ratio, i.e., (total debt in the system) / (total uAD supply). That means the more uCR NFT already bought by participants, the greater the premium at which the next participant is issued uCR NFT.

That’s the usefulness of uCR NFT - it provides an incentive for participants to burn uAD even as the price of uAD continues to decrease - fulfilling goal (2) above.

It’s an acceleration mechanism for contracting uAD supply. The more uAD already burned in the debt cycle, the greater the incentive for participants to burn even more.

Why burn uAD for uDEBTs when I can burn uAD for uAR?

As explained above, x amount of uAD can be burned for at most y amount of uAR in return, where y < x is always true.

In the case of uCR NFT, it is guaranteed that burning x amount of uAD will yield at least x amount of uCR NFT. Usually, the uCR NFT will be issued at a premium, so x uAD will usually yield x + c uDEBTs.

For users capable of writing bots or, in some other way, competing for the redemption of uCR NFT tokens in an upcoming inflation cycle, burning uAD for uCR NFT instead of burning uAD for uCR is much more profitable.