December 2022

Prepared by アレクサンダー.eth

Ubiquity Research Ltd.

We successfully completed our fundraising in May and in the past half year continued to further utilize the financing to grow Ubiquity. Here’s what we’ve been up to since the last update.

House Cleaning

We are taking advantage of current market conditions to further streamline operations and increase efficiencies. For example, instead of racing to ship and launch a rushed product, to a bear market audience, we invested time in augmenting our security infrastructure (including Echidna, Slither, Foundry fuzz testing, Synk, MythX and more soon, all in our continuous integration)

For non-developers reading this, those are automated security auditing tools that check for vulnerabilities every time changes to the code are introduced. Once fully deployed, this puts us on par with the security practices of famously secure projects like Uniswap and MetaMask. We purposefully took additional time and effort to deeply study these top projects’ security practices and included what we thought made the most sense.

We also ported the project over from Hardhat to 100% Foundry, Paradigm’s Solidity development framework, widely regarded as the best-in-class tooling.

With regards to reducing our cash burn rate, we switched primarily towards performance-based compensation and refined our team by letting go of the bottom half of performers on the team.

Treasury

Current Status

- We have about $1.7M of the $2M USD raised on 1 May 2022.

- We have no exposure to LUNA, 3AC, FTX etc.

- Funds are held primarily in a 4/4 Gnosis Multisig Safe on Ethereum Mainnet.

- We have a runway of approximately 3.5 years (May 2026).

- Note that this conservative projection does not include any gains from treasury management strategies (e.g. LP yields) or profits from our upcoming products.

- We deployed half of our treasury in non-incentivized Uniswap V3 ETH-USDC liquidity provisioning.

- For the last few months we generated about $1,130 USD daily on ETH-USDC LP.

- The other half is sitting idle as USDC and DAI in the multisig.

- Our average daily burn rate is about $1,330 USD.

- The daily burn rate is skewed higher due to some post-raise inefficiencies which we have since addressed.

Management Strategy

We are developing a custom TradingView indicator in collaboration with a fund to facilitate research on yield strategy development for our upcoming Vaults program. This is also useful to guide decision making for the treasury management strategy.

For example, the indicator graphs the breakeven line of the ETH-USDC LP position given its current rate of yield. See the diagonal line going down-and-to-the-right.

We always maintain at least half a year of idle cash runway in the treasury to cover operating expenses. This does not include the utilization of yield generation strategies.

If ETH sticks below $1,000 we will:

- Set a new LP range ($1,250-$750) which should double our yield (to ~90% APR) and pull out to spot hold ETH when our breakeven price is ~$1,000 (projected to be three months of LP) or when ETH remains below $750.

- If all of the unallocated treasury funds are spent, not including the six month idle cash runway (current projections would be approximately 400 days for this to occur) then we would open up a Liquity trove with the spot held ETH and borrow LUSD with the expectation that the ~$1M credit line would not come close to liquidation as we are betting that ETH will rise in value within the 3.5 years that it would take for us to use all of that credit (at the current burn rate.) Realistically we could make this line of credit last significantly longer.

- If ETH is trending up in 2023 and beyond, depending on the rate of price appreciation, we may consider using the unallocated treasury funds (aside from the six month runway) to either LP ETH-USDC and/or opportunistically bid ETH.

We have internally weighed the pros and cons of raising another strategic financing round (or perhaps a loan) primarily for bootstrapping our dollar’s liquidity. More on this below under the “Bonds” product update.

Decentralization

We believe that the future of corporations is decentralized. We are excited to be on the front lines of innovating processes and tooling to realize this future (and to make it run efficiently).

The life of Ubiquity DAO began rather centralized. This allowed us to lay down a robust foundation as rapidly as possible for a decentralized future. We are now taking our first steps into this future.

- We are currently experimenting with Telegram “topics” which is similar to Discord Channels. They are not perfect so we still have a large amount of private group chats which we are consolidating. Most of our team prefers Telegram over Discord so we thought that this could be a good solution to organize our chats and make them public.

- We have turned our GitHub into our virtual office space, with most of the detailed discussions (example link) and work (another example) under each repository publicly viewable.

- We are actively recruiting developers from all over the globe. I am excited to share exactly how below.

Talent

Instead of scrambling to recruit just any developer, we spent several months carefully designing our recruiting process to scale. The conclusion we came to is to funnel developers into our Bounty Program to serve as a “paid technical interview” but only pay if they solve a bounty.

This efficiently screens out the developers with low talent, communication, or executional abilities without us having to waste time on calls or direct messages with them. We only invest time in speaking directly with the top bounty hunters in order to onboard them further to grow the core team.

The vision is to create a massive developer talent pool, also known as the Ubiquity DevPool, which we can heavily incentivize at any time when we would like to accelerate our development velocity to best position ourselves to capture ephemeral, but strategic bull market opportunities.

Once this is stable on the developer side, we plan to generalize this system to work across all functions of the DAO, such as research “ResearchPool” and marketing “MarketingPool”.

The Ubiquity Bounty System

“Welcome, Bounty Hunters!”

Every detail of the Ubiquity Bounty System has been carefully designed to minimize management overhead and maximize scalability & capital efficiency.

For example, we have an automated pricing system based on the estimated time for the task, as well as “business impact” or profitability of the feature. We also are actively working on decentralizing the “time estimation” of the bounties to the community (through betting market-like schemes) to establish and price bounties accurately and efficiently.

We also offer direct incentives for our developers to create new bounties, as well as to recruit new developers to complete bounties. The pricing bot, also known as the “UbiquiBot” (or Ubiquity Bounty Bot) is designed to automate all of these processes based on the activities on our GitHub. A discussion on these planned automations and features is available here.

As part of our core mission statement we plan to support community driven product design and development by developing solutions that serve our needs, and eventually open sourcing them to gain influence from the perspective of developers in the ecosystem (and on occasion, charge fees for.)

Our human resource strategy is to be able to keep the core team small and nimble to lead research and complex engineering challenges.

We are carefully designing incentives to obtain the outcomes that we want from our extended (decentralized) team so as to be able to scale our operational throughput while minimizing management and financial overhead.

In addition, we believe that this serves as a low-touch interview process. It allows our team to focus their time on our core research and development instead of miscellaneous functions like initial vetting of candidates.

I believe that recruiting is extremely important to run in perpetuity. As such, I want to be sure that we do it as efficiently as possible.

These intricacies of the Bounty System are all fine and dandy but how do we get developers to join?

Ubiquity Developer Relations

Data Accumulation Strategy

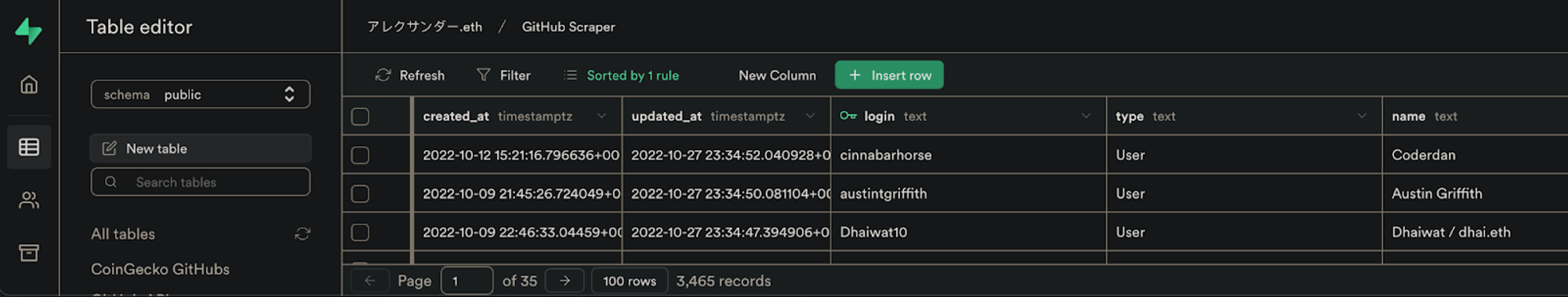

We built a custom scraper to hunt down the GitHubs of top-Ethereum-hackathon participants, particularly those who had code submissions. We now have a database of over 5000 Ethereum developers, and with a ton of metadata associated with each. We also experimented with scraping core developers of projects listed on CoinGecko, CoinMarketCap etc.

You can see the amount of records we have across two collections in our database.

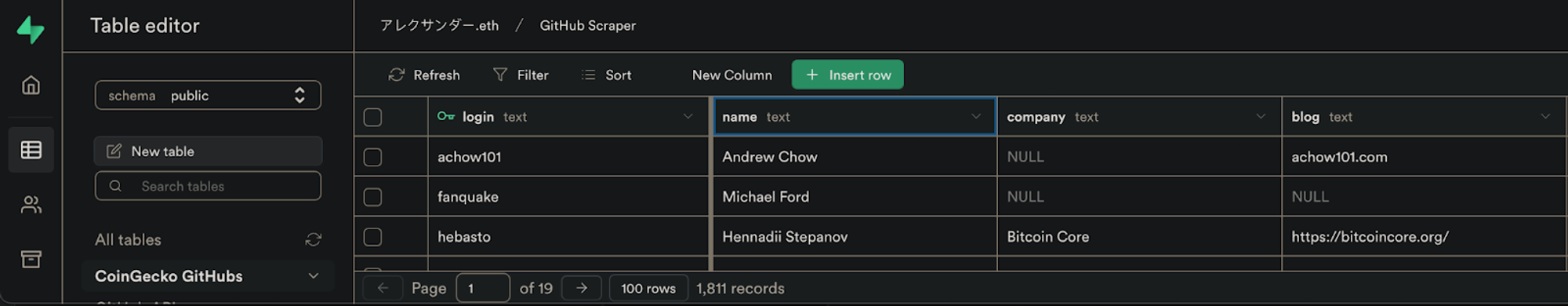

The next step was to understand the most efficient outreach strategy. We parsed through the data, did some data visualization and have identified a trend of “Chad” developers being those who had high follower counts, as well as high code contributions within the last year on GitHub. We will certainly optimize our ranking algorithm further over time but this is good enough to get started.

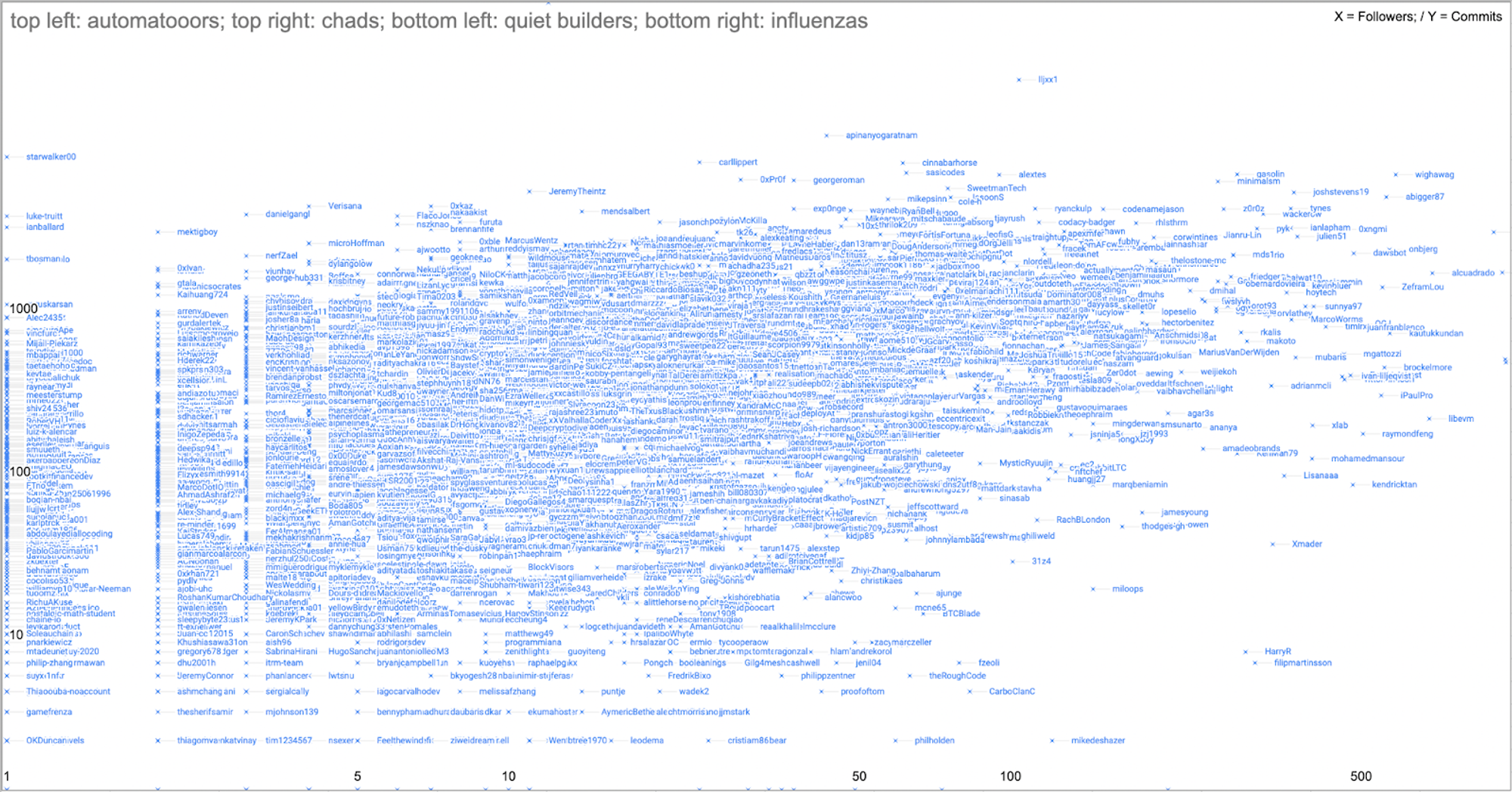

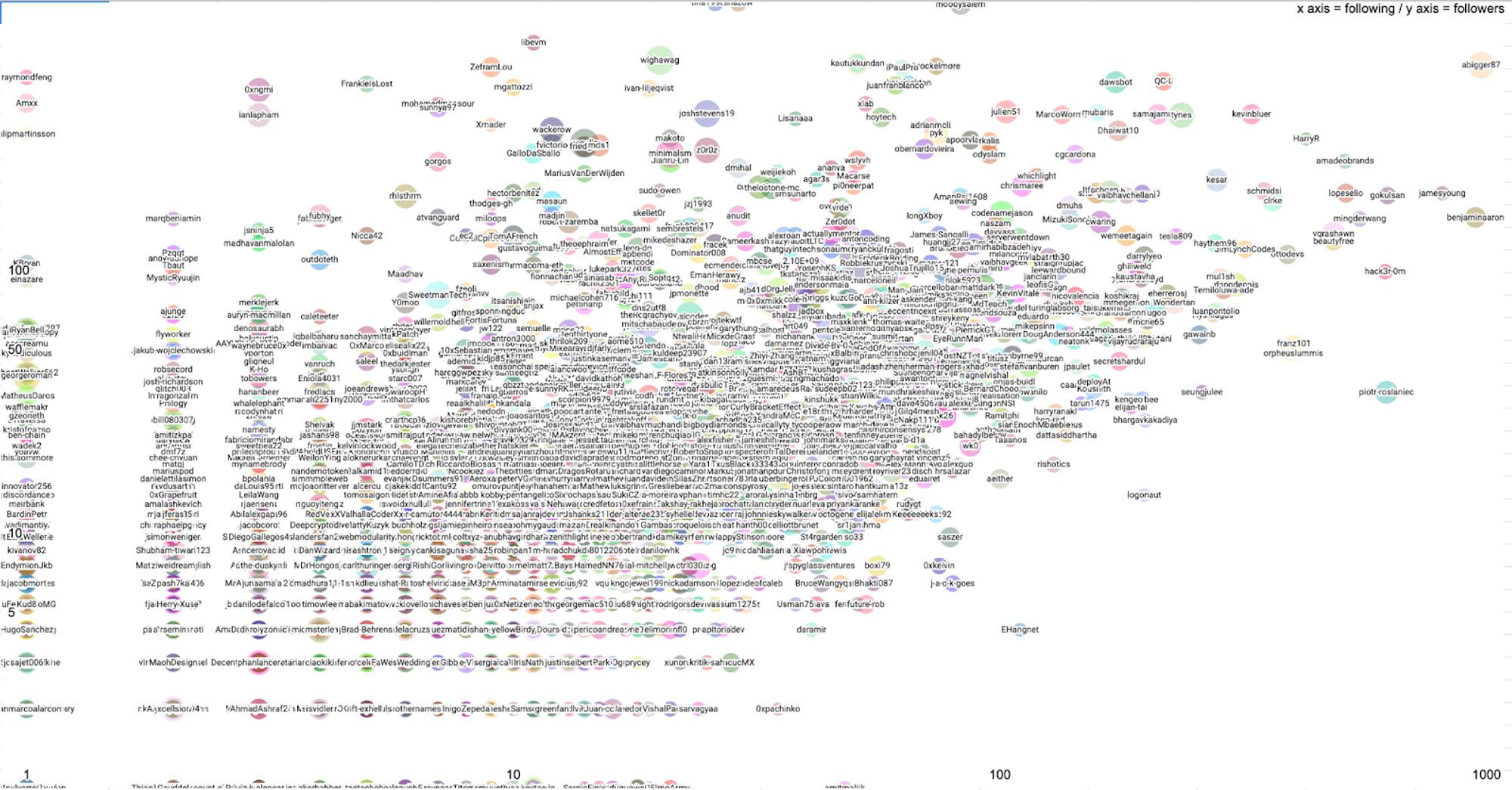

A bonus visualization, which models “sociableness” of prospective candidates.

Outreach

Quantity - Automation

The next steps are to extend the scraper to automatically reach out to the candidates in the following order: GitHub, Telegram, Discord, Twitter; with backward references to each (e.g. “Hey I tried reaching out to you on Telegram before sending this message on Discord!”)

These strategies require a bit of custom tooling so while we prepare for the “quantity” side of the recruiting strategy, we are able to more immediately begin with the “quality” side of the strategy:

Quality - Developer Relations

In order to get started faster, we hired our first Developer Relations manager, or “DevRel” to prototype our process to manually reach out to the top scoring “Chads” mentioned earlier around the data visualization paragraph.

The idea here would be to focus on relationship building and remaining at top of mind for the most talented developers in the ecosystem while bringing their attention to our Bounty Program.

From a more technical perspective, the process we are prototyping now is to associate or “tag” batches of these contacts (we did the top 50 by “Chad” score for our first DevRel) and provide those contacts to the DevRels.

Then the DevRels get paid an extra 20% of the bounties that are solved by the developers associated with the DevRels.

The UbiquiBot will automatically request to send the funds when the bounties are closed via a Gnosis Multisig/Safe and one of the core Bounty Masters will audit and release the funds.

We are exploring more accurate incentive design but we believe that this foundation sufficiently incentivizes recruiters to find capable talent to solve bounties.

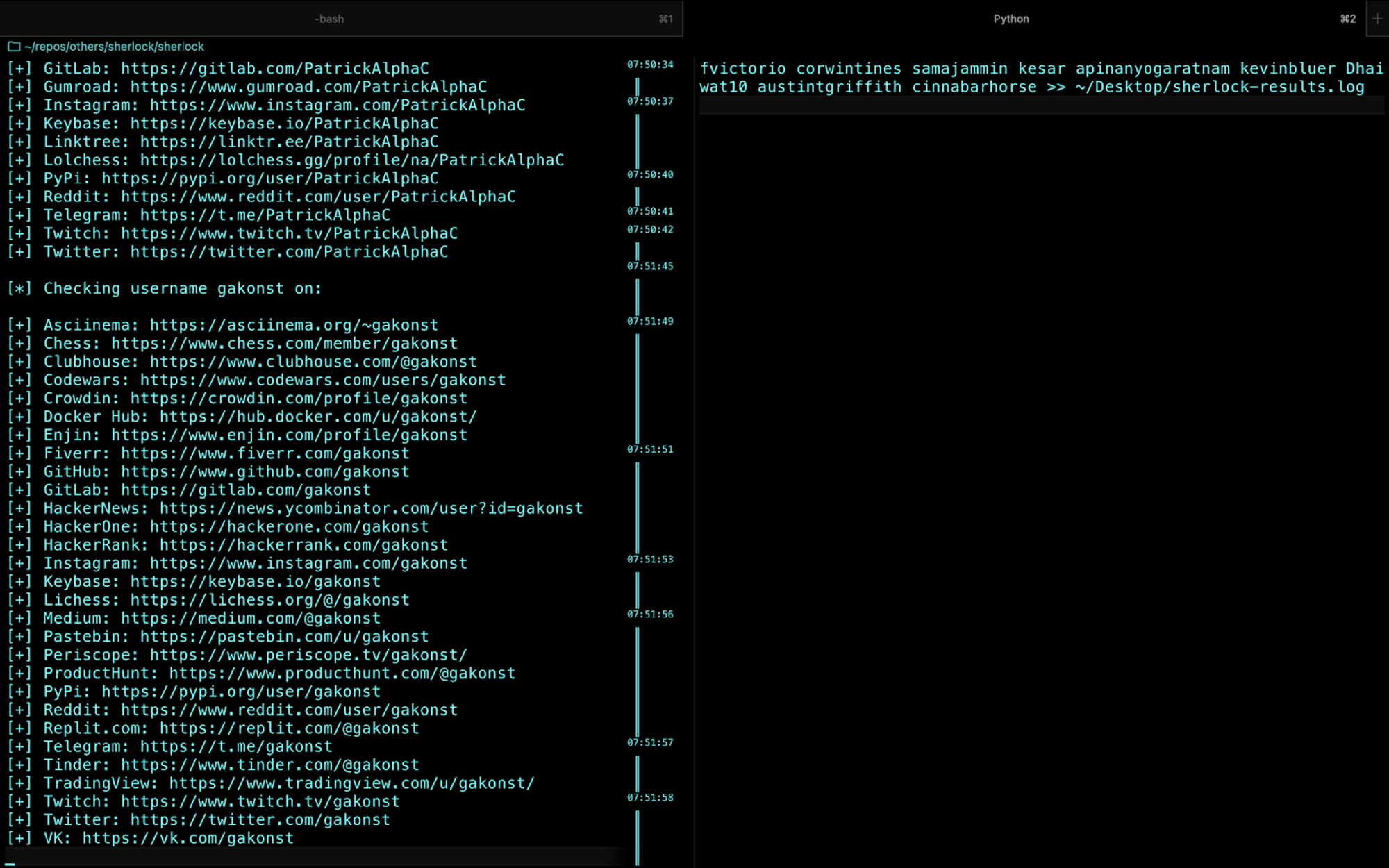

As a final bit of ammunition that we provide for the DevRels is that they also have access to all the associated social media of the leads by leveraging open source tooling such as Sherlock. This allows for multiple outreach channels as well as effective OSINT (information gathering) to augment the outreach success rate.

If push comes to shove, we can always catfish gakonst on Tinder to join the DevPool.

Commercialization

The Ubiquity Bounty System would be a competitor of Gitcoin but potentially cheaper (we can leverage the Ubiquity Dollar to gain “hidden” swap fee revenues) and more useful (incentives automation with the UbiquiBot on the partner projects’ GitHub repositories.)

A close friend of mine, Elu, expressed great interest in commercializing this system. We are currently exploring collaboration opportunities.

Product Updates

The “Updates” sections below are designed to be compared with the Q2 update.

- UbiquiStick NFT

- We are looking to launch this after we have utility ready for it (through our other products.)

- Bonds

- This is our primary means to develop liquidity paired with our dollar. This liquidity is a prerequisite for almost anything in our ecosystem of financial products to work.

- We inked an agreement with ApeSwap for them to implement our Bonds Specification before the new year.

- We agreed that it is strategic to finish development and then launch upon more bullish market conditions.

- We met at the “Animoca Portfolio & Partners” event at Token2049 in Singapore and we believe that co-marketing as part of the Animoca family together could be useful.

- Our capital partners at Concave recently produced a bonds template based on our specification. One of our researchers recently completed an audit which highlights the need for some small adjustments before we can use this as a hedge.

- A brand new bond architecture caught significant interest of our research team, Liquity’s Chicken Bonds system.

- We signed up for their waitlist to work directly with them or if we have extra bandwidth, plan to deploy a rogue instance of their open source contracts.

- We think that their design is the most clever in regards to bonds but as of date is unproven.

- If none of these strategies work for bootstrapping our liquidity, we would more seriously consider obtaining another strategic investment (or loan).

- Lootbox v1 - NFT Cashback Rewards

- This depends on liquidity primarily with uAD-ETH, which will be accommodated by our Bonds strategy.

- We decided to focus on the development of the Yield Aggregator (Vaults) program before cash back rewards. However the expectation is that this should be fast to implement, after we have the required liquidity.

- Proxy Yield Aggregator v1 - ERC4626 Compatible Deposit Contract

- We have two modules of this which are required to implement

- The generalized deposit contract is about finished, we are currently thinking through extra adjustable parameters we may need, as well as some of the architectural details around managing the parameters on a limitless amount of vaults (with considerations to gas fees and being able to easily update potentially hundreds of contracts’ settings)

- The Ubiquity Dollar global protocol manager contract, we are working on upgrading to the Diamond Standard in order to be able to add on management capabilities (parameter adjustment) of any new products, including for this vault program.

Operations Updates

- Recruiting

Our recruiting efforts have been consolidated into our Bounty System and we already have results to show. We welcome top Bounty Hunters within our ranks and offer a humble base pay salary of $4000 USDC to handle ad-hoc (non-bounty) tasks.

- Marketing

- ✅ - our primary marketing efforts are currently handled by the marketing team at Concave but we are looking to add more to the marketing engine by co-hosting our own hackathons using the developers in our DevPool, and working with our partners (starting with those on our cap table).

- Miscellaneous

- Solidity developer relations manager

- ✅

- Recruiting manager

- ✅ - handled in tandem by the Developer Relations Managers and Bounty Masters

- Investor relations manager

- 🚧 - In progress

- Bounty manager

- ✅ - Bounty Masters

- Community managers

- ✅- deprioritized but consolidated within our Bounty community efforts by the product team

- Business development manager

- 🛑 - Deprioritized until after launch

- Investigative journalist

- 🚧 - In progress

- Marketing

- Our partners at Concave produced all of the educational content that we lacked for our products.

- We continuously must strive to reduce clutter and make our materials clear and concise.

- Bounties

- ✅ - Operational and focusing on optimizing efficiencies.

- We started research on productizing the system and charging a fee for other projects to use our infrastructure (including dipping into the talent pool we aggregated).

- Miscellaneous

- N/A

Request For Solutions

We’re looking for help in the following areas!

- Strategy refinement

- If anything mentioned in this document seems like it is headed in the wrong direction- let’s discuss.

- Developer Relations Managers

- Anybody to help promote our Bounty System!

- Growth Hackers

- Individuals who are keen on developing our growth marketing strategy.

- Working closely with an individual to audit and develop campaigns would be useful to ensure that we are tee’d up for the next bull market.