June 2022

Prepared by アレクサンダー.eth

Ubiquity Research Ltd.

Overview

The purpose of this document is to synchronize communications across the cap table efficiently. Please take a look over this document and I’m happy to have an introductory call and answer any questions related to the updates!

Investor Highlights

Financing Completed

Our strategic financing round has been closed successfully. Thank you to the following for participating in this round and welcome aboard!

- Animoca Brands

- Merit Circle

- Momentum6

- Concave

- Ascensive Assets

- SmallCapScience

- Snackclub

- C2 Ventures

- Play Ventures

- DCF Capital

- 369 Capital

- NewTribe Capital

- Balthazar

🥇Momentum6 Social Boost 📈

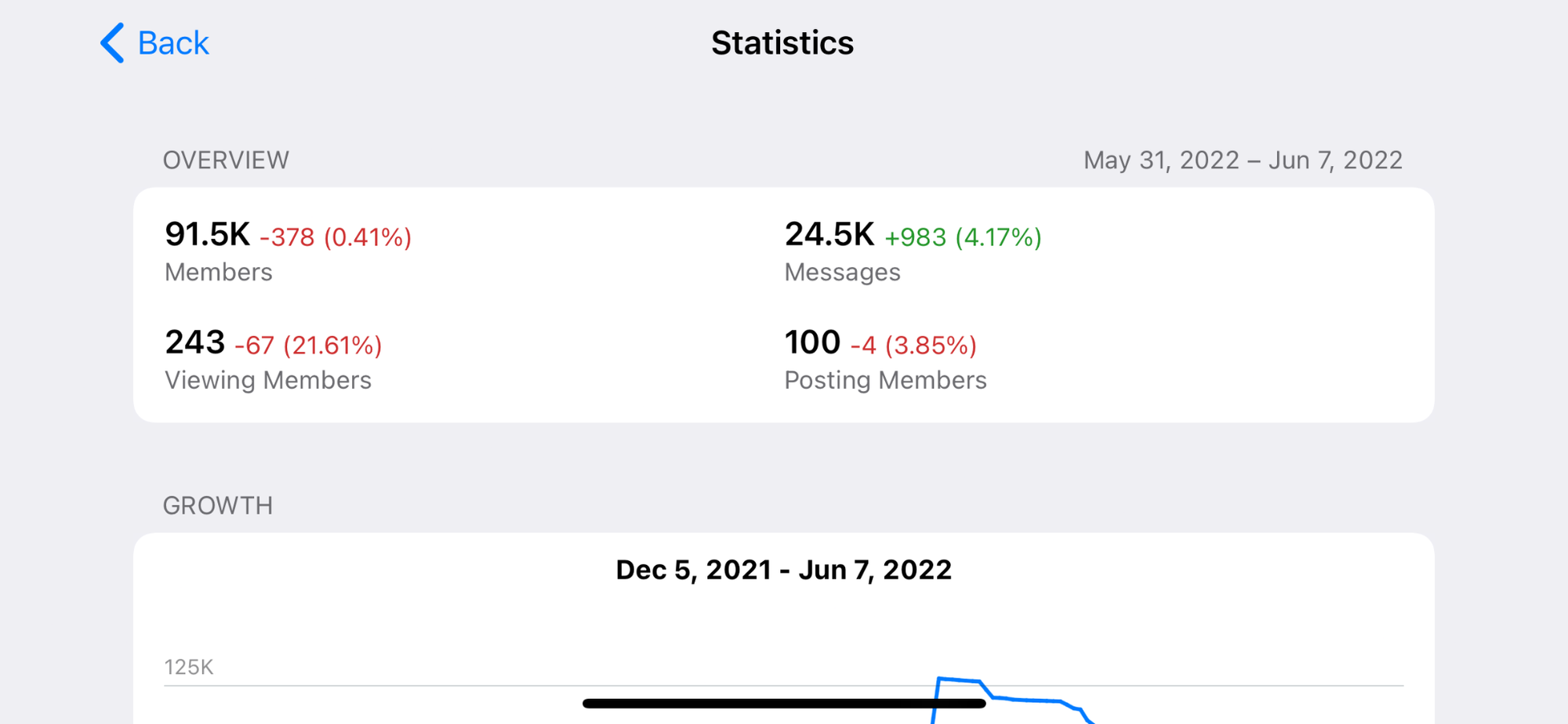

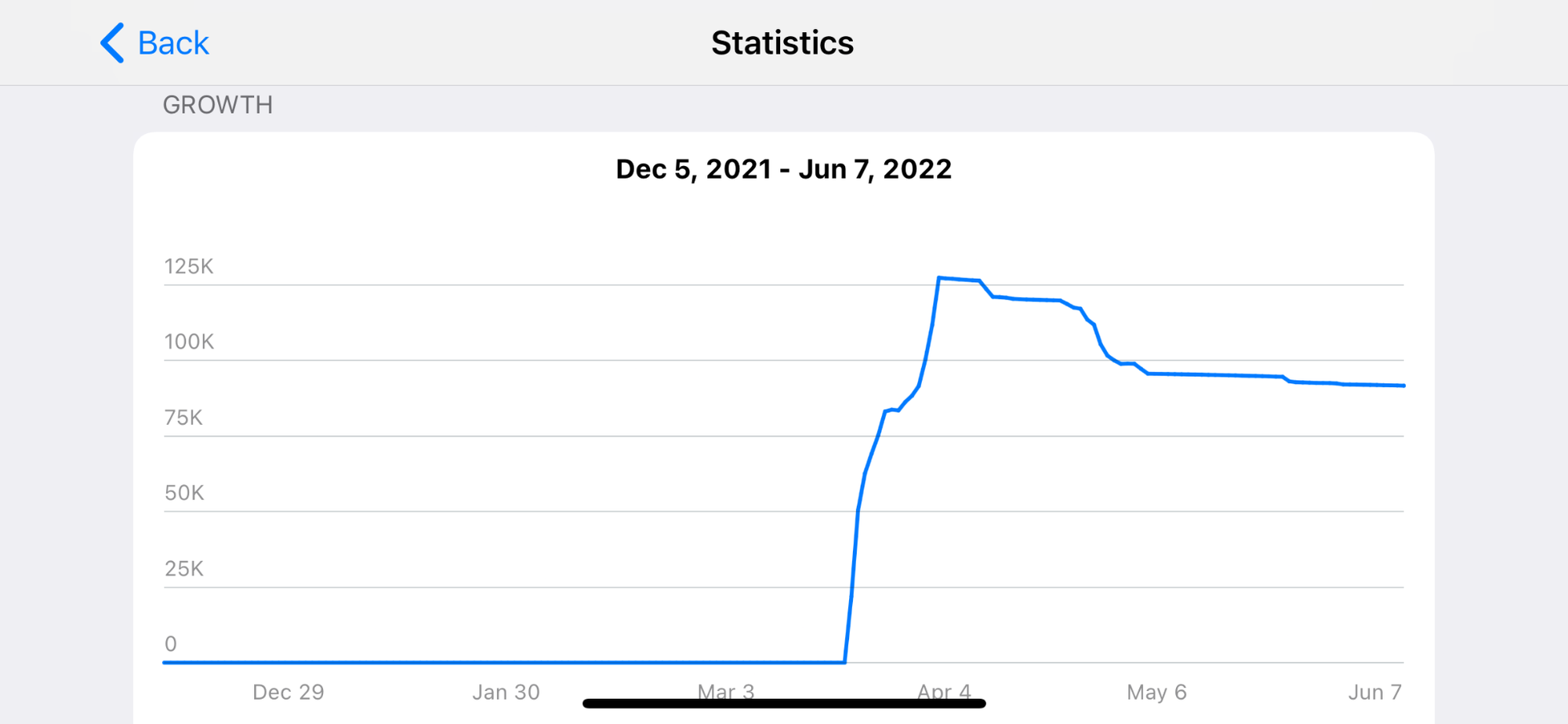

Thanks to Momentum6 for being the first to jump on board, and to their marketing arm for boosting our social media reach! In regards to follower count we saw the following increases:

- ~1000x increase in our Telegram.

- ~20x in our Twitter.

- ~20x in our Discord.

Telegram

Discord

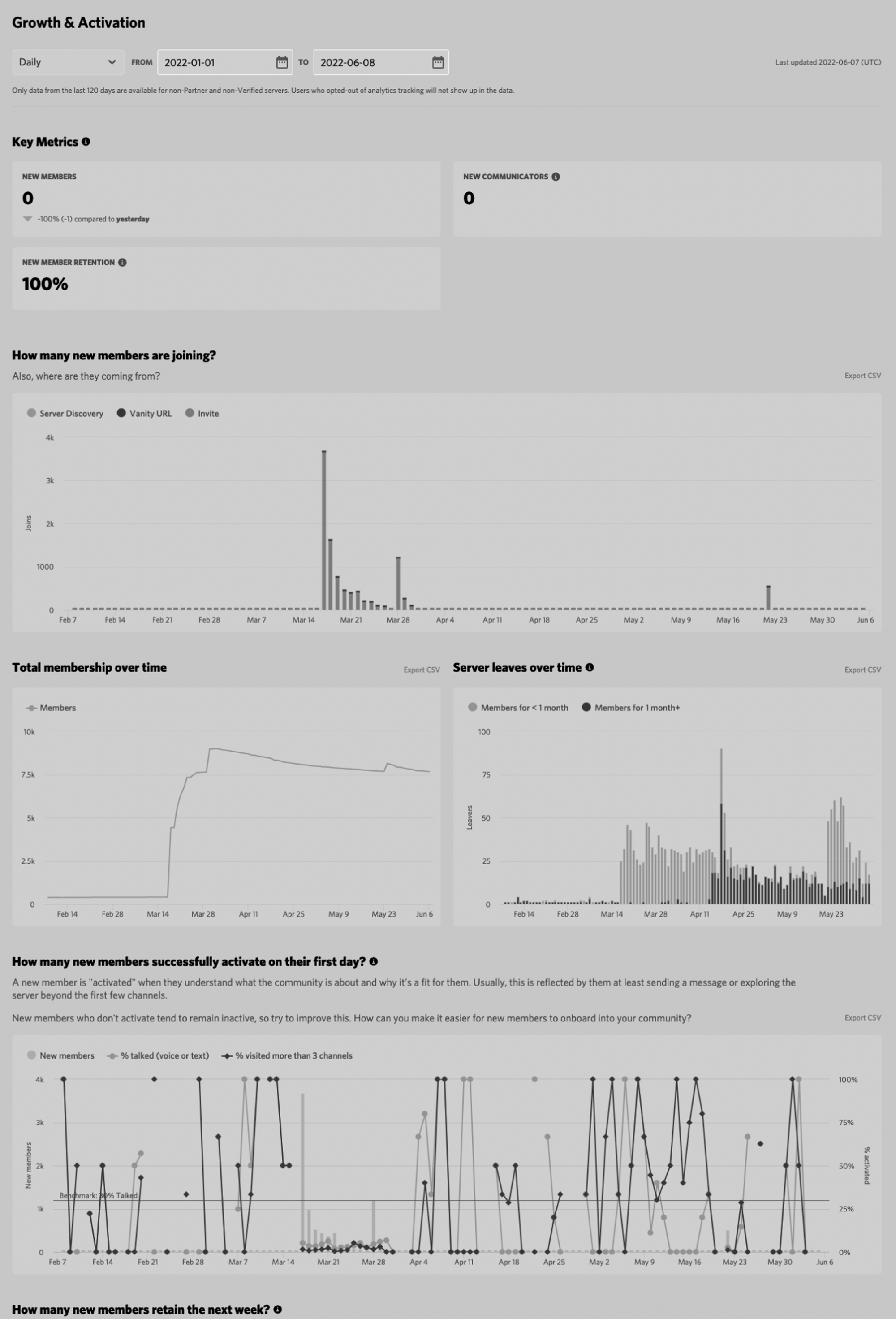

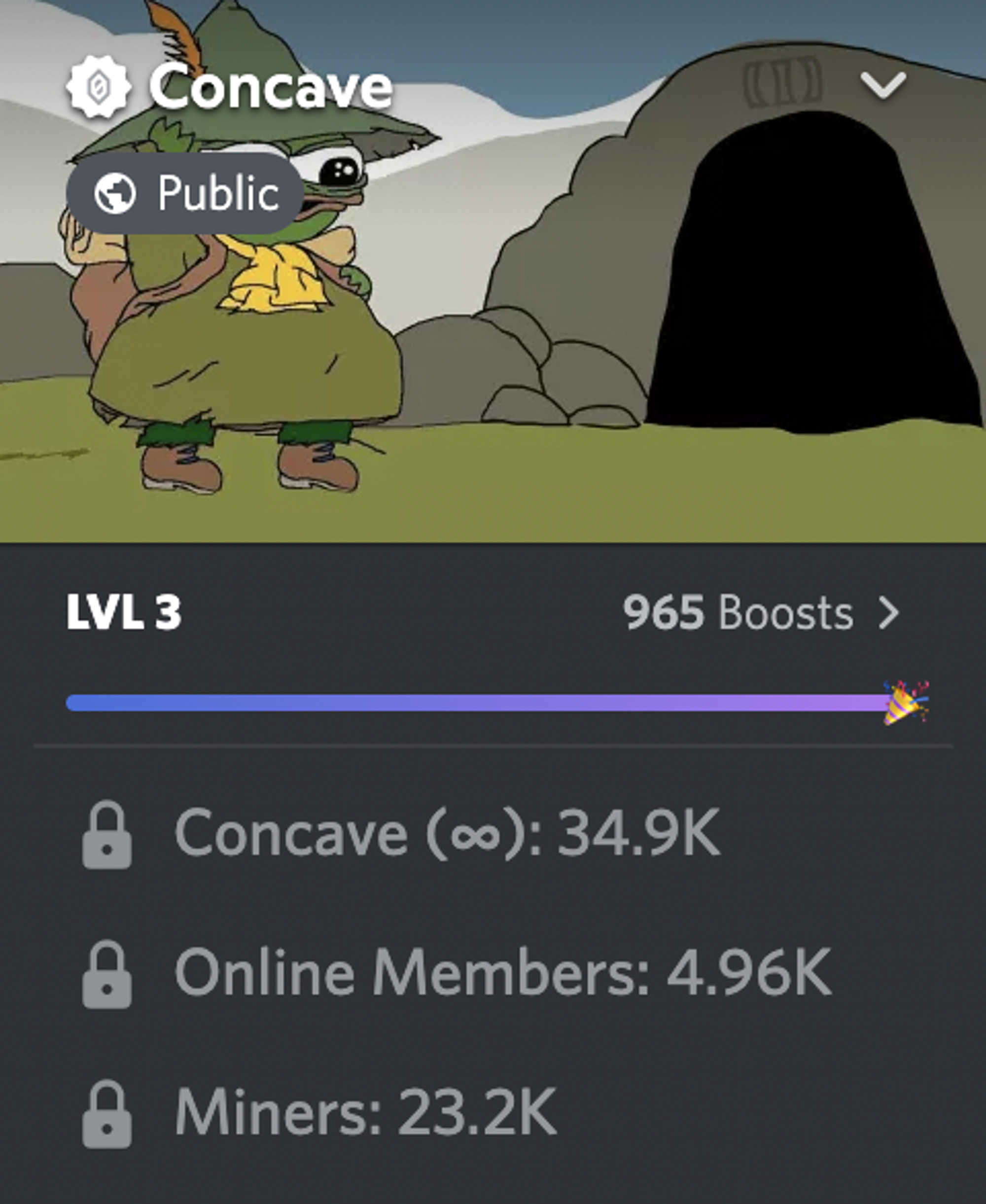

🥈Concave Community Building 🏡

Marketing

Concave marketing team is onboarding now in order to grow and manage our community. Their holistic approach includes but is not limited to: discord gamification, refactoring our documentation, website architecture reorganization, and augmenting the brand concept.

Their action plan is being compiled in the following document:

Their Discord is a good example of their community development capabilities.

Engineering

We’ve had several conversations on their engineers guiding our team for developing our own bonds program, as some of the original engineers behind Olympus bonds are currently on the Concave engineering team.

We’re exploring possibilities to further our collaboration around the Ubiquity bonds program, including signing on to Concave’s bonds-as-a-service in tandem with our own development efforts. The rationale for developing our own version is because it is prudent of us to have control over our primary means of raising liquidity.

🥉Ascensive Assets Recruiting Introduction 🤝

Thanks for the introduction to Encode to help us with our ongoing recruiting and bounty efforts!

Product Updates

UbiquiStick NFT

- This allows for access to public beta testing of all of our future products.

- Standing by to distribute whitelist/mint access and launch along with our Bonds, our first scheduled-to-be-released product.

- We are considering creating a “UBQ sink” by having the only way to obtain a UbiquiStick is to burn UBQ along a bonding curve (every UbiquiStick is more expensive than the last)

- We are analyzing the marketing and economic impacts of this distribution strategy compared to the originally planned whitelist mint structure.

- Contracts (and artwork) have been ready for some time now, with small enhancements being added while we standby for launch.

- One recent enhancement: with the NFT owner’s authorization we have the ability to update the NFT metadata, per ID.

- This means we have creative freedom to increase engagement in the future by, for example, having owners perform certain actions within our UIs, which will yield a visually altered/enhanced UbiquiStick.

- Bonds

- Olympus style bonds program to raise liquidity paired with our dollar.

- This is designed to rapidly grow our collateral reserves, as well as the circulating supply of Ubiquity Dollars.

- Liquidity raised from the Bonds are a prerequisite before the Lootbox v1 idea can be implemented

- Lootbox v1 - NFT Cashback Rewards

- This is the first step on our journey to create an incentivized NFT purchasing marketplace to stack on top of existing marketplaces (e.g. OpenSea, LooksRare) which will be one of the first ways we can facilitate game-fi partners.

- Proxy Yield Aggregator v1 - ERC4626 Compatible Deposit Contract

- Originally designed as a means to raise collateral for our dollar in perpetuity.

- We incentivize users to farm through our deposit contract so that we can take some of their yield in exchange for uCR.

- Objectively superior compared to going directly to the underlying yield source because:

- The user can decide their risk tolerance upon withdrawal:

- Risk off: allows the user to withdraw the underlying yield only (plus their principle) as if they went directly to the yield source.

- OR risk on: boost their yields by giving uCR in exchange for the underlying assets, with a bonus (e.g. 1 USDC => 2 uCR)

- This includes a slider so they can define their risk profile along a continuum.

- The vision is to dynamically generate a suite of yield bearing vaults by having the users connect their favorite ERC4626 compatible interface yield source.

Technical specifications of all products can be found on our GitHub.

Operations Updates

Recruiting

We’ve high priorities around recruiting high quality engineering talent, followed by high quality marketing talent. Miscellaneous and less urgent roles to fill are listed below.

- Engineering

- We have prioritized growing our Solidity developer cache and are currently sourcing talent from the following sources on top of our collaboration with encode.club:

1) Telegram groups | 2) Discord servers | 3) Web3 Hackathon contacts | 4) Web3 groups on Linkedin | 5) Freelance marketplaces | 6) Web3 hiring websites |

ㅤ | ㅤ | ㅤ | ㅤ | ㅤ | ㅤ |

Web3 hiring | Servers on Hackathons | Web3 freelance websites | Paid websites | ||

ETHGlobal | |||||

World Innovation Day | ㅤ | ||||

Magnet DAO | ㅤ | ㅤ | |||

Mintbean | ㅤ | ㅤ | ㅤ | ||

TBD | TBD | ㅤ | ㅤ | ㅤ | |

ㅤ | ㅤ | ㅤ | ㅤ | ㅤ | |

ㅤ | ㅤ | ㅤ | ㅤ | General freelance marketplaces | |

Solidity hiring | Specific servers with Hackathon channels | ㅤ | ㅤ | TBD | ㅤ |

Graph protocol - Hackathons | ㅤ | ㅤ | ㅤ | ㅤ | |

Near - Near hacks | ㅤ | ㅤ | ㅤ | ㅤ |

- In particular we are prioritizing staffing the following types of Solidity developers

- At least one DeFi focused Solidity developer comfortable/familiar with the following:

- Olympus style bonds

- Yearn style yield vaults

- At least one NFT focused Solidity developer comfortable/familiar with the following:

- NFTs

- NFT auctions

- At least one full time TypeScript+React (user interface) developer

- Marketing

- We are transitioning to a more grassroots community management and marketing focus with strategies that worked for Concave.

- To facilitate carrying out these strategies, we should consider poaching community and marketing talent from other DAOs in decline, especially those with relevant products, including but not limited to: Beanstalk, Olympus, Rome, Klima

- Miscellaneous

- Solidity developer relations manager

- To stay at top of mind with members of our Solidity development cache and to curate talent for specific tasks well suited for the developer.

- Recruiting manager

- To facilitate perpetual recruiting efforts

- Investor relations manager

- To sync updates with investors with higher frequency

- Bounty manager

- To “bountify” needs of the organization

- e.g. setting prices per task as well as distributing rewards.

- Community managers

- Telegram

- Discord

- Business development manager

- To originate new partnerships and collaborations

- Investigative journalist

- To be the voice of the core team for the public

- Marketing

- Top-of-Funnel (Twitter)

- Educational content on our products on Medium and Notion.

- Minimize signal-to-noise because we need to reduce the clutter on our Notion and Medium

- Bounties/competitions on Twitter:

- Thread writing

- Memes

- Community (Discord)

- Gamification of our Discord

- Custom stickers

- Bots and automation

- Bounties

- The product team has been busy brainstorming and developing a robust bounty system which will be used to incentivize the community to perform functions on behalf of the DAO.

- We are rolling out the first set of bounties on our GitHub with a task scoring system.

- Alongside with encode.club, we will be raising awareness for these open issues any developer can complete, in exchange for a reward.

- After prototyping the system on GitHub, we plan to expand our bounty infrastructure (e.g. automation) in order to scale operational throughput, while reducing (risky) salary burn rate organization wide.

- Miscellaneous

- Ubiquity Governance token vesting algorithm completed. This will handle calculations of future token distributions and ensure accuracy down to the millisecond.

- Token distribution up-to-date: https://etherscan.io/tx/0x61ffc2a27f8ae87cb3cb9795fbaee9aee694ca25a32a9118a0179ecf2ead7acb

- Development of partnerships and other project collaborations are deferred until after Bonds and Lootbox v1 are operational.

- This infrastructure is a prerequisite for us to be in a position to add value to other partners.

Request For Solutions

"Ask not what your Ubiquity can do for you - ask what you can do for your Ubiquity." —John F. Kennedy

We’re looking for help in the following areas!

- Recruiting

- Bounty setup (distributing operations)

- Strategy refinement

- If anything mentioned in this document seems like it's headed in the wrong direction, let’s discuss.