At its core, the Ubiquity protocol is designed to be highly responsive to market conditions in order to maintain the Ubiquity Dollar’s intended peg at $1.

It was recognized early on in the design phase that completely uncollateralized stablecoins, while capital efficient, have been unable to maintain their pegs in the face of heavy selling pressure or malicious actors. Consequently, partial collateralization of the Ubiquity Dollar (uAD) will be rolled out in Q4 2021.

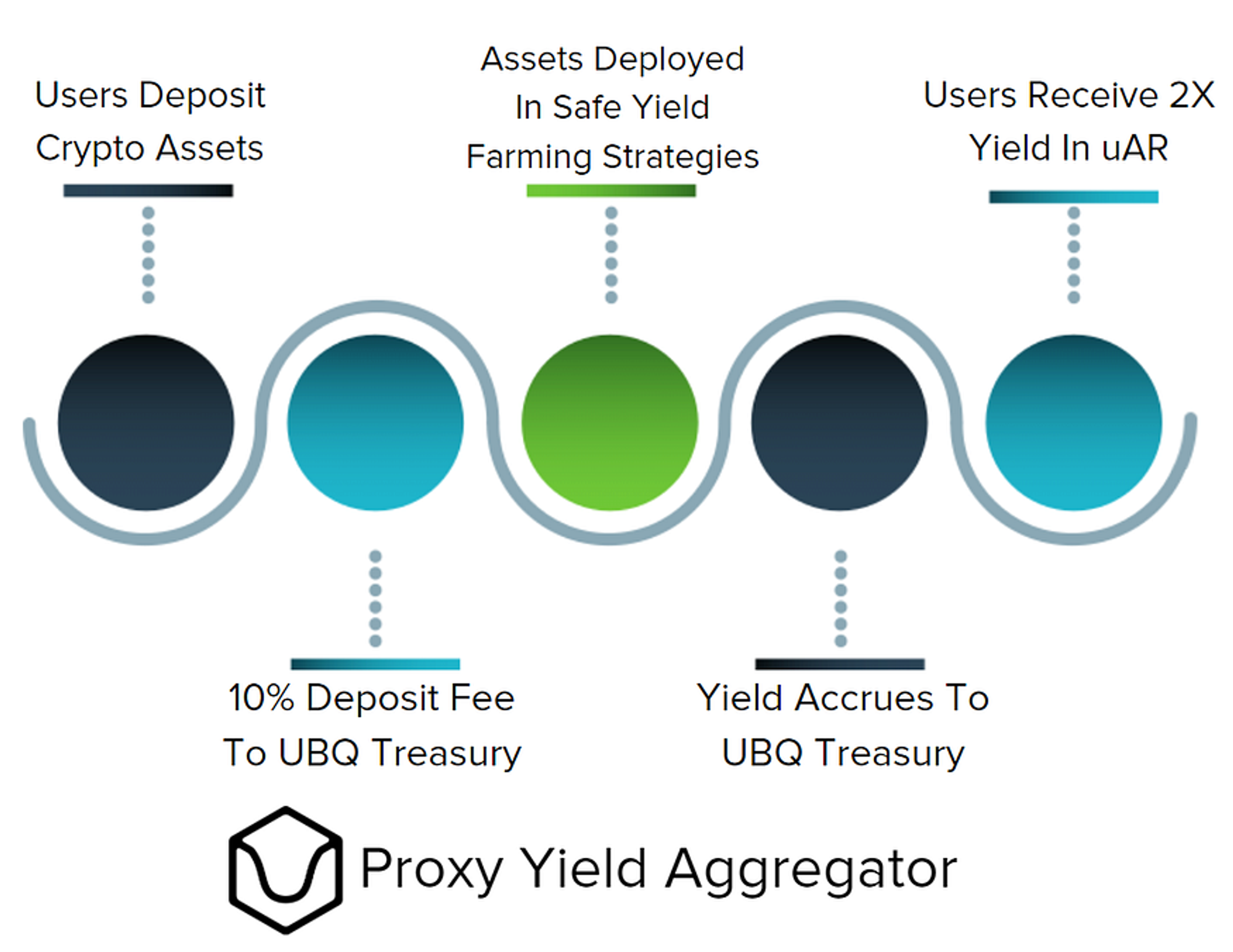

A stablecoin is only as good as its use-cases, and the Ubiquity team is excited to present our Proxy Yield Aggregator, which will offer users double the yield on their crypto assets while building up collateral reserves for uAD.

How It Works

- Users may deposit their choice of stablecoins (DAI/USDC/USDT) into the Proxy Yield Aggregator (PYA)

- A 10% Deposit Fee is levied and accrues to the UBQ Treasury (Collateral Reserve)

- PYA deploys stablecoins into conservative yield farming strategies like Yearn/AAVE with strategies vetted through Ubiquity governance.

- The yield generated is kept by the protocol and further augments the uAD collateral reserve.

- Users receive DOUBLE the underlying yield in the form of uAR tokens. uAR tokens are perpetual debt tokens issued by the Ubiquity protocol that can be redeemed for 1 uAD when the stablecoin trades above $1.

Advantages For Users

- Financial Incentive — The PYA offers 2X the yield vs directly farming the underlying protocols.

- Simple UX — The PYA is a fire-and-forget solution for users looking for attractive stablecoin yields. Our strategists will deploy the deposited assets in the highest-yielding farms after approval from Ubiquity DAO participants.

Benefits to the Ubiquity Protocol

- Collateral Reserves will allow for partial collateralization of uAD as planned for Q4.

- The PYA will allow us to target a broader base of DeFi users looking for a simple stablecoin yield solution. This opens up possibilities for further engagement with the protocol in the future.