23 June 2021

Ubiquity Editorial Staff

Ubiquity is now a little over a week into its fair launch, and considerable progress has been made in the development and adoption of the protocol. With over half a million dollars’ worth of liquidity and the price strongly retaining its stability – the furthest divergence being around $1.09 – the protocol has in this early stage remained an accordingly successful launch in the world of stablecoins. The development team has been rapidly improving upon the protocol and its interface in real time, and those interested in the project can definitively expect more to come in the near future.

Modification to Staking Rewards

As of 22 June, the Bonding contract has received a total of 48 deposit transactions, with 12 opting to stake for 1 week and 13 having locked funds for the full 208 weeks or four-year period. We appreciate the early interest and support, and we take this to be reflective of strong organic interest in Ubiquity’s stablecoin at such an early point before our sustained marketing campaign.

With this in mind, we are announcing an important change to the way that the staking duration multiplier is applied to rewards. This multiplier is implemented as a way to incentivize long-term deposits, as it increasingly rewards users who have a vested interest in the long-term success of the protocol by applying an increasing multiplier to rewards based on staking length. The initial implementation applied this multiplier not only to seigniorage and UBQ rewards – conceivable as the interest a user would ultimately receive for staking – but also to the proportional share of the LP token pool, affecting the principal the user initially deposited their funds with. This implementation applied the multiplier to the shares of the LP token pool on an immediate basis upon staking user funds, which entailed the possibility of a significant but inaccessible gain in ownership for long-term stakers. However, due to the subsequent dilution of the LP token pool, this would also entail a proportional and immediate loss of principal for short-term deposits. Users who stake for a period shorter than the maximum thus would be risking an immediate loss of their principal at any moment when other users decide to stake for a comparably longer duration, up to the four-year maximum.

Example: Let's say you deposit 1 LP token (aka uAD3CRV-f) inside the bonding contract for 1 week – in return you get 1 Bonding shares.

Let us also assume that at the time this constitutes 100% of the total bonding pool.

If I were to then deposit 1 LP token inside the bonding contract for 208 weeks, in return I would receive almost 4 Bonding shares due to the way the initial implementation of the multiplier worked. In this scenario, you end up with 20% and I end up with 80% of the bonding share.

If you were to then withdraw immediately after your week-long bonding contract expires, you will only get 20% of 2 LP (that is, 0.4 LP) instead of the 1 LP you initially deposited, entailing a significant loss of your principal.

Although such an implementation benefits long-term stakers and strongly incentivizes these kinds of deposits, it ultimately punishes short-term stakers in a way that is both unjustifiable and unsustainable – long-term staking should be incentivized, but short-term staking serves an important role as well and should in turn not be disincentivized or made economically infeasible. Because of this, the staking rewards multiplier has been modified to only apply to interest (seigniorage and UBQ rewards), and not to the user’s deposited principal (their share of the LP token pool upon deposit). Users affected by this change will see it applied retroactively to their LP tokens, and are not at risk of a loss of funds.

Temporary notice: it is important that users with 1 week deposits do not withdrawal funds before this change is applied to their tokens.

A "Migrate" function will be added with a corresponding UI button which will take care of the upgrade process seamlessly for affected users. This will retroactively apply the new multiplier to users' bonding shares and migrate the deposits to the new bonding contract. It is again important that users do not take any action until they see this feature implemented. It is also important that users migrate existing deposits to the new contract using this feature, as failing to do so will entail missing out on further LP token and UBQ rewards.

It is worth noting that this is made possible, and is proceeding in accordance to design, by the DAO’s present governance state in the "Rapid Prototyping Period". This initial phase in the DAO's development is crucial to working out and iterating upon these early modifications in a safe and controlled manner. During this period, it should also be noted that the raiseCapital function will be used by the team to mint new uAD in order to build the treasury’s reserve and fund ongoing development. As a part of the Rapid Prototyping Period, control of contracts using this function is currently one-sided and unrestricted – however, as the DAO development phase rollout continues and we exit the Rapid Prototyping and Cool Off periods, this will change to being an exclusively governance-based contract, to be used as seen fit exclusively by the community. See the documentation pages https://dao.ubq.fi/treasury-module and https://dao.ubq.fi/governance-module to learn more.

Community Highlights

We would also like to highlight some of the particularly outstanding community interactions we have had since launch.

“Let’s make something great” – kiryu

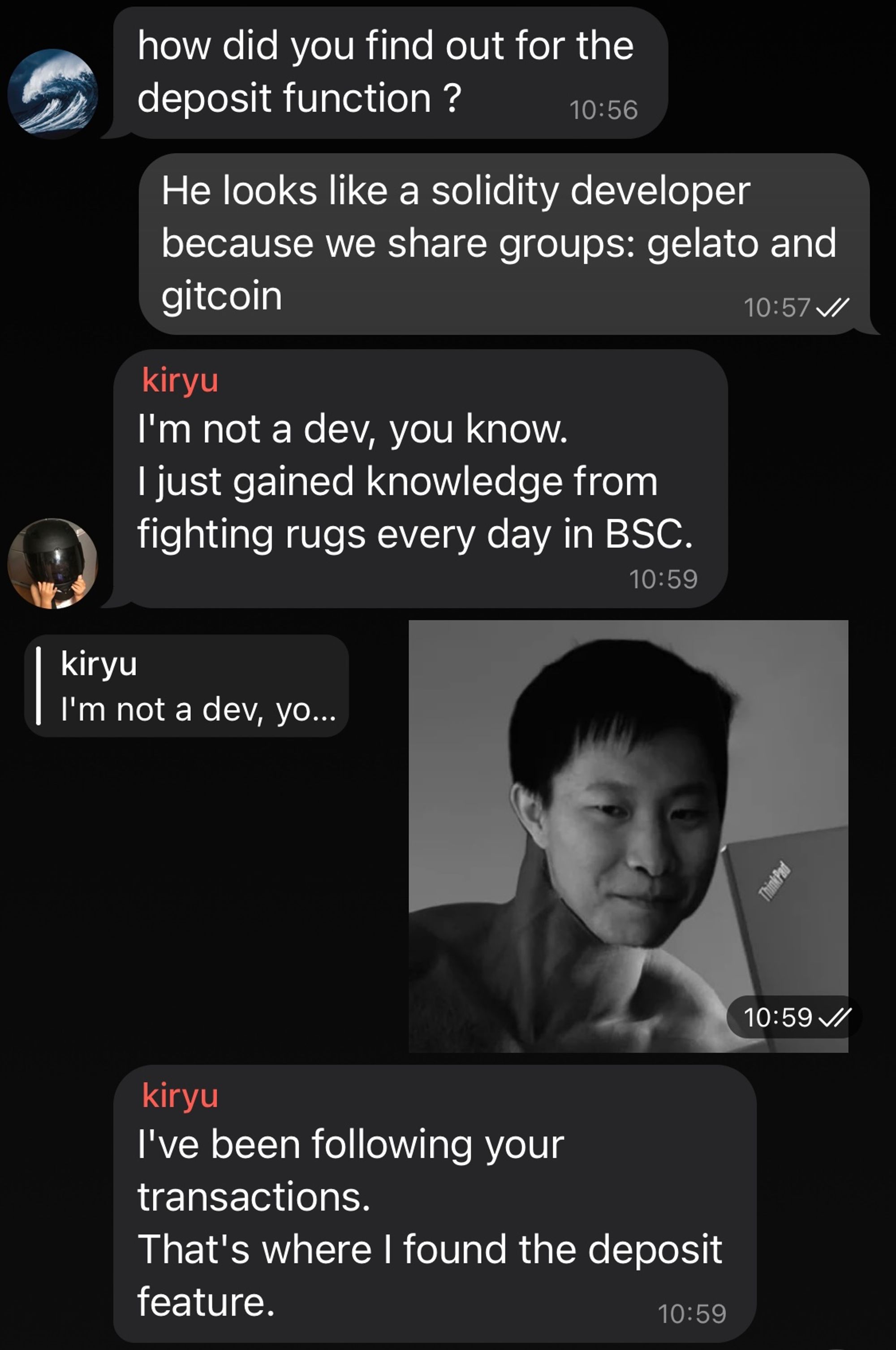

First up is kiryu, a Japanese DeFi yield-farming veteran with extensive hands-on experience working with smart contracts. kiryu is the first non-developer user of Ubiquity’s protocol, as he happened to use it before Ubiquity had even officially launched – by tracking transactions the team was making through Etherscan, he was able to uncover Ubiquity’s deposit contract and began to farm UBQ before the user interface was even implemented! kiryu then proceeded to carry out a conversation with our development team using translation software to switch between Japanese and English, where he sought clarification regarding the existence of pre-mined tokens, and afterwards selflessly returned the tokens he was able to farm. Although we would not quite recommend freely employing incomplete features (this should rather be saved for our upcoming Bug Bounty program), we readily welcome anyone with as much passion and propensity for exploration to the community to help improve Ubiquity’s development efforts and user experience. Many thanks to kiryu for this interesting and fun interaction.

“see y'all in 4 years!” – Larry the Cucumber

Next is none other than Larry the Cucumber, inquisitive DeFi enthusiast and co-founder of the widely known farming platform Pickle Finance. Larry has provided us with consistently high-quality and prescient questions as well as technical feedback, each of which have provided greater clarity to the community and even direct improvements to the dApp’s UI. User questions similar to these will eventually be refined and compiled into an enhanced FAQ section, so if you have anything to ask us which you cannot find or clarify in our documentation, please do so! Many thanks to Larry for his interest in the project and presence in the Ubiquity Discord.

Thank you for your continued interest and support for Ubiquity. The community engagement we have received is greatly appreciated and very important, and we look forward to growing alongside, through and eventually as this community.

Sine stabilitate nihil habemus.